Bonus tax calculator 2021

The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Youll notice this method gives a lower tax amount ie.

How To Calculate Bonuses For Employees

R258083 R260000.

. Under this example the claimant will have received a grand total of 1105 between the standard rebate and one-time bonus rebate. Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25. Calculate the average total earnings paid to your employee over the current financial year to date.

You will need to. Usual tax tax on bonus amount. Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada.

Sage Income Tax Calculator. ATO app Tax withheld calculator. It covers most scenarios but youll need to use the full version outlined above if you are not an Australia resident for tax purposes are a working holiday.

The current Social Security tax rate is 62 percent for employees. A claimant who received the maximum standard rebate of 650 for the 2021 claim year will receive an additional one-time bonus rebate of 455 70 of the original rebate. Travel allowance included in salary.

R534083 - R518083 R160 than the annualisation method does meaning that Thandis tax being withheld is closer to her eventual tax liability. Use the relevant tax table to find the amount to be withheld from the average total earnings in step 1. To start complete the easy-to-follow form below.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. Pay Rise Tax Calculator 2021 views. Thandis total tax for March 2020 will then be.

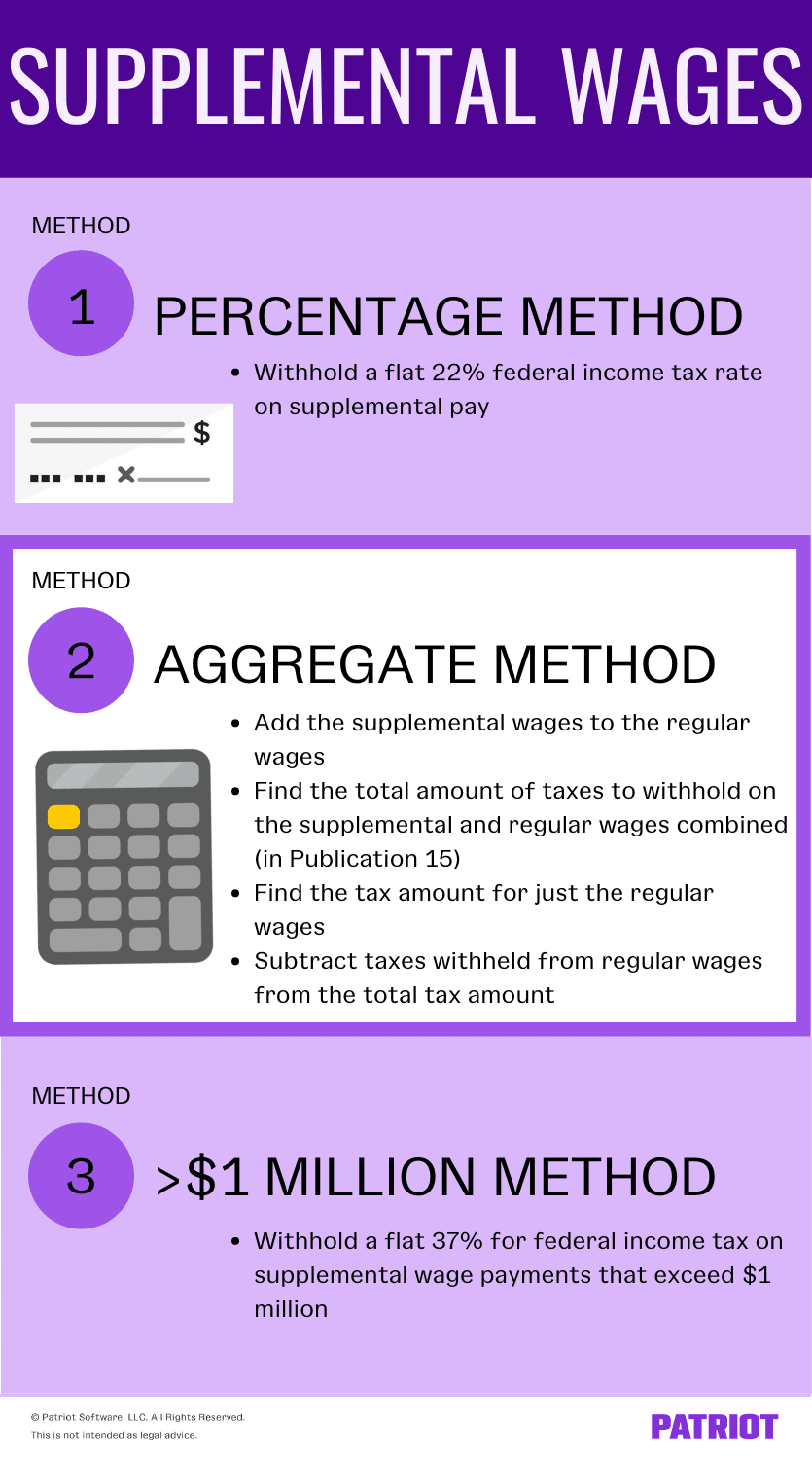

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. This calculator uses the Aggregate Method.

Bonus included in salary. FREE INCOME TAX CALCULATOR BY. This is known as the Social Security wage base limit.

Use our Bonus Tax Calculator to see the amount of tax paid on a bonus on top of regular salary. YourTax Terms and conditions. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Bonus Pay Calculator Tool. Stamp Duty Calculator 484 views. Generally most employers chose to use the percentage method.

The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. It will take between 1 and 2 minutes to use. Tax Code Calculator 489 views.

The payroll calculator from ADP is easy-to-use and FREE. The aggregate method or the percentage method. Its so easy to use.

Free South African income tax calculator for 20212022. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Salary Inflation Calculator - Is Inflation Taking The Wind Out Of Your Pay.

Calculates income tax monthly net salary bonus and lots more. Add as a plugin or widget to any website. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Discover Helpful Information And Resources On Taxes From AARP. It is perfect for small business especially those new to payroll processing. Calculate how tax changes will affect your pocket.

Qualifying homeowners also may receive a. Rather than using a flat tax rate the bonus is added to regular wages to determine the additional taxes due. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Employers typically use either of two methods for calculating federal tax withholding on your bonus. A tax calculator for the 2021 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

In 2021 you will pay FICA taxes on the first 142800 you earn. The ATO app includes a simplified version of the Tax withheld calculator for use by employers and workers.

What Is The Bonus Tax Rate For 2022 Hourly Inc

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Are Bonuses Taxed At A Higher Rate Bonus Tax Rate Methods

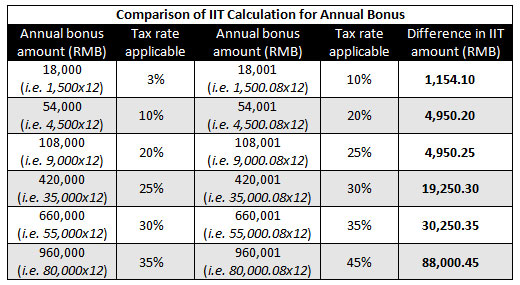

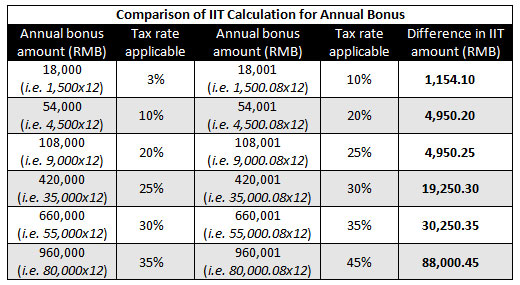

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Bonus Tax Rate In 2021 How Bonuses Are Taxed Wtop News

China Annual One Off Bonus What Is The Income Tax Policy Change

Pin On Everything About Car Tyre

Bonus Calculator Percentage Method Primepay

Download Bonus Paystub Template 04 Paycheck Statement Template Payroll Checks

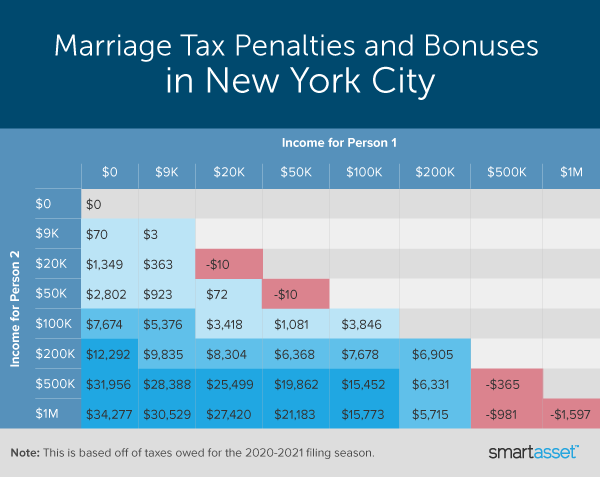

Marriage Penalty Vs Marriage Bonus How Taxes Work

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

What Are Marriage Penalties And Bonuses Tax Policy Center

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

How Bonuses Are Taxed Calculator The Turbotax Blog

Avanti Bonus Calculator

How Bonuses Are Taxed Calculator The Turbotax Blog

What Is The Bonus Tax Rate For 2022 Hourly Inc